90% More Chances to Win Projects With Our Estimate!

- Multi-Family Building

- Hotel Building

- Hospital Building

- Warehouse Building

- School & University Building

- High-Rise Building

- Shopping Complex

- Data Center Building

Choosing between a single-family home and a multi-family home is a significant decision that can impact your lifestyle, finances, and long-term investment goals. Each type of residence has its advantages and disadvantages, catering to different buyer needs and market trends. This article aims to explore the essential aspects of both options, providing a comprehensive guide for potential homeowners and investors.

In today’s rapidly changing real estate landscape, understanding the nuances between single-family and multi-family homes is crucial for making informed decisions. The shift in demographic preferences, coupled with economic factors, has made it necessary to explore not only the basic definitions but also the intricate details that set these two property types apart.

A single-family home is a standalone structure designed to accommodate one family. These homes offer privacy, space, and a yard, making them popular among families and individuals seeking a personal living space. Typically, single-family homes are built on their own plots of land and are characterized by their separate entrances, garages, and outdoor spaces.

Overall, single-family homes are an excellent option for those seeking a comfortable and private living experience, often positioned in family-friendly neighborhoods.

Multi-family homes are residential buildings designed to house multiple families within separate living units. This category includes duplexes, triplexes, apartments, and condominiums. Multi-family homes are often more affordable per unit and can serve as excellent investment opportunities.

In summary, multi-family homes cater to a diverse range of lifestyles and can accommodate various living situations, from families to young professionals seeking community-oriented living.

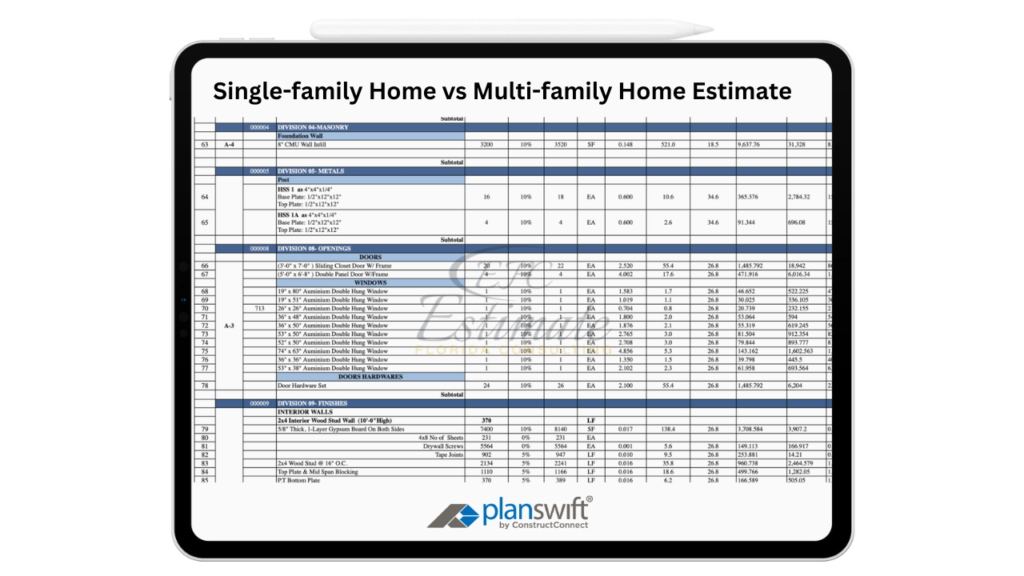

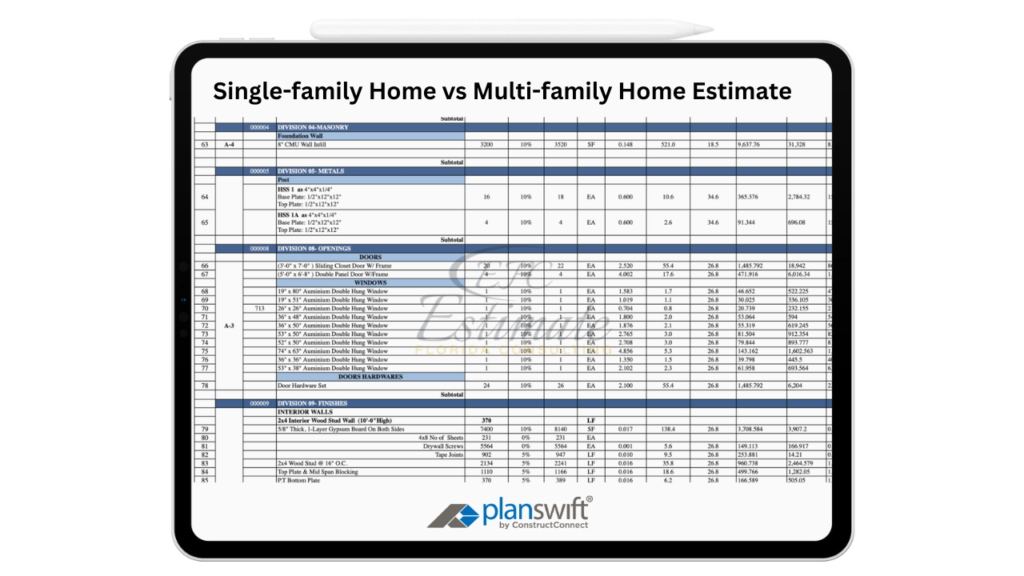

Understanding the construction costs associated with single-family and multi-family homes is crucial for potential buyers and investors. Factors such as location, materials, and design intricacies play a significant role in determining overall costs.

The average construction cost for single-family homes in Florida typically ranges from $234 to $468 per square foot, depending on various factors, including location, design, and materials used. A modest 2,000-square-foot single-family home could cost between $468,000 and $936,000.

Cost Component | Estimated Cost per Sq Ft | Total Estimated Cost (2,000 Sq Ft) |

Basic Construction | $234 – $312 | $468,000 – $624,000 |

Custom Features | $312 – $468 | $624,000 – $936,000 |

The table above outlines the construction costs for single-family homes, reflecting a range based on different levels of customization. Factors like high-quality finishes, eco-friendly materials, and advanced technology integrations can significantly influence the cost.

Multi-family homes generally have lower construction costs per unit due to shared walls and amenities. The average cost ranges from $195 to $390 per square foot. A 4-unit building with a total area of 4,000 square feet could cost between $780,000 and $1,560,000.

Cost Component | Estimated Cost per Sq Ft | Total Estimated Cost (4,000 Sq Ft) |

Basic Construction | $195 – $260 | $780,000 – $1,040,000 |

Custom Features | $260 – $390 | $1,040,000 – $1,560,000 |

The table above illustrates the average construction costs for multi-family homes, showcasing potential savings compared to single-family homes. Additionally, the economies of scale in multi-family construction often lead to reduced per-unit costs, making this a strategic option for investors.

When considering the long-term value and income potential, both single-family and multi-family homes present unique opportunities.

Overall, the investment potential of multi-family homes is significant, especially for those looking to build a real estate portfolio.

Maintenance and management responsibilities differ significantly between single-family and multi-family homes, influencing the long-term commitment required from homeowners and investors.

Single-family homeowners are solely responsible for all maintenance tasks, including yard work, repairs, and renovations. While this provides complete control over property conditions, it can also require substantial time and financial investment. Homeowners may need to allocate funds for periodic updates and repairs, which can add to the overall cost of ownership.

Multi-family properties often involve shared responsibilities. Property owners typically hire property management services to handle maintenance, tenant relations, and other operational tasks. This can ease the burden on individual owners but incurs additional management fees. While property management can streamline operations and ensure professional upkeep, it also reduces direct control over property conditions and tenant interactions.

Understanding current market demand and trends for both single-family and multi-family homes can provide valuable insights for potential buyers and investors.

The demand for single-family homes remains strong, particularly among families seeking larger living spaces. With remote work becoming more prevalent, many individuals are prioritizing home offices and outdoor spaces. Trends such as smart home technology and energy-efficient features also influence buyer preferences, leading to a heightened demand for modern amenities.

Multi-family homes are increasingly popular among young professionals and investors due to urbanization and housing shortages. As cities expand, more individuals seek affordable housing options close to urban centers. Additionally, developments that include shared amenities, such as co-working spaces and recreational areas, attract tenants looking for a community-centric lifestyle.

Financing options play a crucial role in purchasing both single-family and multi-family homes, affecting affordability and investment potential.

Homebuyers typically rely on traditional mortgages, which often come with lower interest rates and longer repayment terms. Additionally, many buyers may qualify for first-time homebuyer programs, which can help reduce upfront costs. This makes financing single-family homes relatively straightforward for many buyers.

Financing multi-family homes can be more complex, often requiring commercial loans rather than traditional residential mortgages. Lenders may assess the property’s income-generating potential, leading to stricter qualification criteria. However, financing options like FHA loans for multi-family properties can make ownership accessible for investors looking to enter the market.

Tax implications vary between single-family and multi-family homes, impacting overall investment returns.

Homeowners may benefit from mortgage interest deductions and property tax deductions on their federal tax returns. Additionally, capital gains tax exemptions may apply when selling a primary residence, allowing homeowners to retain a portion of their profit.

Investors in multi-family homes can take advantage of various tax benefits, including depreciation deductions, which can significantly reduce taxable income. Additionally, operational expenses such as property management fees and maintenance costs can be deducted, enhancing overall profitability.

The location of a home significantly impacts its value, livability, and investment potential.

Single-family homes are often found in suburban areas, appealing to families seeking space and community. In contrast, multi-family homes are typically located in urban centers, catering to young professionals and individuals prioritizing proximity to work and entertainment.

Neighborhood factors, such as schools, amenities, and safety, play a crucial role in attracting buyers to single-family homes. Multi-family homes benefit from accessibility to public transportation and urban conveniences, enhancing their appeal to potential tenants.

Long-term value appreciation varies between single-family and multi-family homes, influencing investment strategies.

The demand for single-family homes tends to appreciate over time, driven by factors such as population growth, economic stability, and neighborhood development. Homeowners can expect their property values to rise, especially in desirable locations.

Multi-family homes also appreciate in value, though they may be influenced by different market dynamics. Factors such as rental demand, vacancy rates, and local economic conditions can impact the value of multi-family properties, making them potentially less stable than single-family homes.

The community and lifestyle associated with single-family and multi-family homes differ significantly, affecting residents’ overall living experience.

Single-family homes often promote a strong sense of community, with homeowners typically more invested in their neighborhoods. Families can develop lasting relationships with neighbors, fostering a supportive environment.

Multi-family living encourages interaction among residents, often resulting in vibrant community dynamics. Shared amenities and common areas provide opportunities for socialization, making multi-family homes appealing for those seeking connection and community engagement.

When comparing single-family homes and multi-family homes, potential buyers and investors must consider various factors, including construction costs, investment potential, market trends, and community dynamics. Each option offers unique advantages and challenges, making it essential to align personal goals and preferences with the right choice.

For those seeking a family-oriented lifestyle, single-family homes may provide the desired space and privacy. Conversely, multi-family homes present attractive investment opportunities for individuals looking to generate income and build wealth.

Single-family homes are standalone structures meant for one family, while multi-family homes contain multiple units that can house different families.

Multi-family homes usually have lower construction costs per unit due to shared walls and infrastructure, allowing for economies of scale.

The investment potential depends on individual goals. Single-family homes may appreciate more over time, while multi-family homes offer consistent rental income.

Location significantly affects home values. Single-family homes are often more valuable in family-friendly neighborhoods, while multi-family homes thrive in urban areas with high rental demand.

Investors can explore commercial loans, FHA loans for multi-family properties, and other financing options designed for income-generating properties.

It depends on your goals. A single-family home offers more personal living space, while a multi-family home can provide rental income that may help cover mortgage payments.

At Estimate Florida Consulting, we offer detailed cost estimates across all major trades, ensuring no part of your project is overlooked. From the foundation to the finishing touches, our trade-specific estimates provide you with a complete and accurate breakdown of costs for any type of construction project.

We take pride in delivering accurate, timely, and reliable estimates that help contractors and builders win more projects. Our clients consistently praise our attention to detail, fast turnaround times, and the positive impact our estimates have on their businesses.

Estimate Florida Consulting has helped us win more bids with their fast and accurate estimates. We trust them for every project!

Submit your project plans, blueprints, or relevant documents through our online form or via email.

We’ll review your project details and send you a quote based on your scope and requirements.

Confirm the details and finalize any adjustments to ensure the estimate meets your project needs.

Receive your detailed, trade-specific estimate within 1-2 business days, ready for your project execution.

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

All copyright © Reserved | Designed By V Marketing Media | Disclaimer