90% More Chances to Win Projects With Our Estimate!

- Multi-Family Building

- Hotel Building

- Hospital Building

- Warehouse Building

- School & University Building

- High-Rise Building

- Shopping Complex

- Data Center Building

Leading provider of average cost to build a multifamily home estimating.

Building a multifamily home can be a rewarding investment, whether you’re developing apartments, townhomes, or condominiums. Understanding the average cost to build a multifamily home is essential for developers and investors looking to secure financing and ensure project profitability. This guide will break down the costs involved, factors that influence pricing, and tips for effective budgeting, providing a thorough overview of the multifamily construction landscape.

A multifamily home is a residential building designed to accommodate multiple separate housing units, catering to various living arrangements. These can include apartments, townhomes, or condominiums, making them an attractive option for investors looking to generate rental income or developers aiming to meet housing demand in urban areas. Multifamily homes can serve diverse demographics, from young professionals seeking affordable housing to families looking for spacious accommodations. The construction of multifamily homes often focuses on efficient land use and the integration of communal facilities, enhancing both property value and community engagement.

The average cost per square foot for building a multifamily home can vary significantly based on location and design choices. On average, the cost ranges from $156 to $390 per square foot. Below is a breakdown of estimated costs based on different project types and sizes.

Project Type | Estimated Cost Per Square Foot |

Low-rise Apartments | $156 – $325 |

Mid-rise Apartments | $234 – $364 |

High-rise Apartments | $325 – $520 |

Understanding these estimates allows developers to gauge the financial feasibility of their projects. For instance, if you’re considering a high-rise building in a city center, anticipate costs on the higher end of this range due to increased material and labor demands associated with taller structures. Properly evaluating these costs against projected rental income will help in making informed decisions regarding investments.

Understanding the average costs for different types of multifamily homes can help developers make informed decisions about their projects. Each type comes with its own unique costs and considerations that can impact overall budgeting.

For a standard apartment building, the cost can range from $169 to $390 per square foot. Additional costs can arise from amenities such as fitness centers, pools, and communal spaces. When budgeting for apartments, consider the costs associated with landscaping, parking structures, and communal areas that enhance tenant appeal.

Size of Apartment (sq ft) | Estimated Total Cost |

1 Bedroom (800 sq ft) | $135,200 – $312,000 |

2 Bedroom (1,200 sq ft) | $202,800 – $468,000 |

Designing for energy efficiency and modern living standards can increase initial expenses but lead to long-term savings for both developers and residents. For example, incorporating energy-efficient appliances and green building materials can yield significant operational cost savings.

Townhomes generally cost between $208 and $364 per square foot. The total cost will depend on the number of units and the complexity of the design. Townhomes can often leverage shared walls to reduce overall heating and cooling costs, a key selling point for buyers.

Size of Townhome (sq ft) | Estimated Total Cost |

1,500 sq ft | $312,000 – $546,000 |

2,000 sq ft | $416,000 – $728,000 |

Many townhome developments also include community features such as parks or common recreational areas, which can further increase the project’s overall appeal but should be factored into your budget.

Condominiums often command higher prices due to the added amenities and upscale finishes. The cost typically ranges from $260 to $455 per square foot. These properties often focus on luxury features, such as high-end appliances, quality materials, and superior building techniques.

Size of Condominium (sq ft) | Estimated Total Cost |

1,200 sq ft | $312,000 – $546,000 |

1,800 sq ft | $468,000 – $819,000 |

Additionally, many condominiums incorporate shared amenities like pools, fitness centers, and rooftop terraces, which can enhance property value but should be budgeted appropriately.

Before commencing construction, developers must account for permits and regulatory fees. These can vary significantly based on local regulations and the size of the project. Fees may include zoning permits, building permits, and inspection fees. It’s essential to research the local requirements to budget accurately for these costs. Moreover, understanding the timeline for obtaining these permits is crucial, as delays can push back project timelines and increase costs.

Type of Permit | Estimated Cost |

Building Permit | $1,300 – $6,500 |

Zoning Permit | $650 – $2,600 |

Environmental Review Fee | $1,300 – $13,000 |

It’s advisable to engage with local government agencies early in the planning process to ensure compliance and avoid unexpected costs or delays during construction.

When planning a multifamily project, understanding land costs is crucial. The cost of land varies widely based on location, zoning regulations, and market conditions. In urban areas, land costs can reach as high as $1,950,000 per acre, while suburban areas may average around $650,000 per acre, and rural land can be much cheaper, averaging $26,000 to $130,000 per acre. It’s essential to consider land acquisition as part of your overall budget and to engage local real estate experts to identify suitable plots that meet your development goals.

Location | Average Cost Per Acre |

Urban Areas | $650,000 – $1,950,000 |

Suburban Areas | $130,000 – $650,000 |

Rural Areas | $26,000 – $130,000 |

This table illustrates the significant variance in land costs across different geographical areas. Conducting thorough market research and potentially partnering with local real estate experts can assist in identifying suitable land options at competitive prices.

Understanding the various factors that influence the cost of building a multifamily home is crucial for accurate budgeting and financial planning. Every project is unique, and the interplay of these factors can dramatically impact the final cost.

The location of the construction site significantly impacts costs. Urban areas typically have higher land prices, permitting fees, and labor rates compared to rural locations. Additionally, construction costs can vary based on local building codes and regulations, which may necessitate specific materials or construction techniques. For instance, constructing a multifamily home in a metropolitan area may incur additional expenses for site preparation and infrastructure development, such as the installation of utilities and accessibility features. Proximity to amenities like schools, parks, and public transport can also influence buyer interest, thereby affecting overall project costs.

The design and complexity of the multifamily home also play a significant role in determining costs. A more complex design will require specialized labor and higher-quality materials, both of which can increase expenses significantly. Features such as balconies, elevators, and communal areas will add to the overall project cost, along with high-end finishes that appeal to luxury buyers. Moreover, contemporary architectural trends, which often call for sustainable building practices, may involve additional expenditures upfront but can lead to long-term savings through energy efficiency and lower maintenance costs. Custom designs or high-rise constructions will necessitate advanced planning and consultation with architects, potentially inflating costs further.

Material costs are a significant component of construction expenses, fluctuating based on market demand, economic conditions, and availability. Prices for essential materials like wood, concrete, and steel can vary dramatically. Recent supply chain disruptions and inflation have made it crucial to account for potential price increases in your cost estimates. As an example, the cost of lumber saw unprecedented hikes, affecting residential construction budgets nationwide. Additionally, sourcing sustainable materials can often come with a premium but can enhance the property’s marketability, appealing to environmentally conscious buyers. As you plan your budget, consider the quality of materials that will meet the durability and aesthetic standards expected in multifamily living spaces.

Labor costs for construction can vary greatly depending on the location, availability of skilled workers, and project complexity. As demand for housing increases, labor shortages can drive up wages significantly. Average labor rates can range dramatically based on the type of work, region, and the complexity of the construction task. For instance, skilled trades such as electrical, plumbing, and HVAC installation command higher rates due to their specialized nature. Effective project management and scheduling can help mitigate labor costs, ensuring that work progresses smoothly and efficiently, ultimately saving time and reducing overall expenses.

Investing in multifamily homes offers numerous advantages. For one, they provide the opportunity for diversified income streams, as multiple units can generate rental income simultaneously. This setup often leads to improved cash flow and financial stability for property owners. Additionally, multifamily homes typically require lower maintenance costs per unit compared to single-family homes, as common areas can be serviced collectively. Moreover, with the increasing demand for rental properties in urban centers, multifamily homes often appreciate in value more rapidly than single-family dwellings, making them a sound investment choice.

Securing financing for multifamily construction can be complex, given the significant investment required. Various financing options are available, ranging from traditional bank loans to government-backed programs. Each option has unique advantages and drawbacks, so it’s essential to assess your financial situation and project goals.

These loans are typically offered by banks and financial institutions and usually require a substantial down payment, often ranging between 26% and 39% of the total project cost. Conventional loans can be particularly advantageous for well-established developers who have a solid credit history and financial stability. These loans often come with competitive interest rates, allowing developers to manage their financing costs effectively. However, it’s important to note that these loans may require extensive documentation and can involve a lengthy approval process, which can delay project timelines if not planned for adequately. Furthermore, borrowers should consider how the interest rates may fluctuate over time and how that will impact overall project financing.

Federal Housing Administration (FHA) loans are government-backed financing options that typically allow for lower down payments, often as low as 3.5%. This makes FHA loans particularly appealing for first-time developers or those with less capital to invest upfront. However, these loans often come with stricter qualification criteria, including credit score requirements and limits on loan amounts based on local housing markets. Additionally, FHA loans may involve mortgage insurance premiums that increase overall costs, so developers should carefully analyze these factors when considering this option. Engaging with a lender experienced in FHA loans can provide valuable insights and help navigate the qualification process effectively.

Hard money loans offer a unique financing solution by providing short-term loans with quick access to capital, which is crucial for developers needing immediate funding. These loans are usually secured by the property itself and are funded by private investors or companies rather than traditional banks. While hard money loans can provide fast capital, they often come with higher interest rates, typically ranging from 12% to 15%, and shorter repayment terms, usually between six months to three years. Developers should be cautious with this option, as the costs can accumulate quickly, impacting overall project profitability. Additionally, having a solid exit strategy is vital when using hard money loans, as developers need to ensure they can repay the loan within the stipulated timeframe.

Forming partnerships with other investors can be a strategic way to finance multifamily construction projects. By pooling resources and sharing the financial burden, developers can access more capital while also distributing risks associated with the project. Partnerships can vary in structure, from joint ventures to limited partnerships, and can also bring additional expertise and experience into the project, enhancing its overall execution. However, it’s important for all parties involved to clearly define roles, responsibilities, and profit-sharing arrangements upfront to prevent misunderstandings later on. Effective communication and legal agreements are critical in ensuring that the partnership remains beneficial for all stakeholders throughout the project lifecycle.

Investing in multifamily homes offers numerous advantages. For one, they provide the opportunity for diversified income streams, as multiple units can generate rental income simultaneously. This setup often leads to improved cash flow and financial stability for property owners. Additionally, multifamily homes typically require lower maintenance costs per unit compared to single-family homes, as common areas can be serviced collectively. Moreover, with the increasing demand for rental properties in urban centers, multifamily homes often appreciate in value more rapidly than single-family dwellings, making them a sound investment choice.

Accurate cost estimation is vital for the success of any multifamily construction project. Here are some effective strategies for estimating costs:

Conducting thorough market research is the foundation of accurate cost estimation. Start by analyzing local construction trends, labor rates, and material costs specific to your project location. Research recent projects similar in scope and size to gauge average costs. Engage with local suppliers to get current pricing for materials, as prices can fluctuate based on market conditions and demand. Additionally, consider factors such as seasonality, as certain times of the year may see higher demand for labor and materials, leading to increased costs. By developing a comprehensive understanding of the local market, you can create a more realistic budget that accounts for current economic conditions and trends.

Collaborating with experienced professionals such as architects, engineers, and seasoned contractors can significantly enhance the accuracy of your estimates. These experts bring a wealth of knowledge and experience to the table, helping to identify potential cost-saving measures or design efficiencies that could reduce overall expenses. During the planning phase, schedule meetings with these professionals to discuss project specifics and gather their insights on material selection, construction methods, and local code requirements. Their input can help refine your estimates, ensuring they are based on practical experience rather than solely on theoretical costs. Additionally, building strong relationships with these professionals can lead to better negotiation opportunities with suppliers and subcontractors.

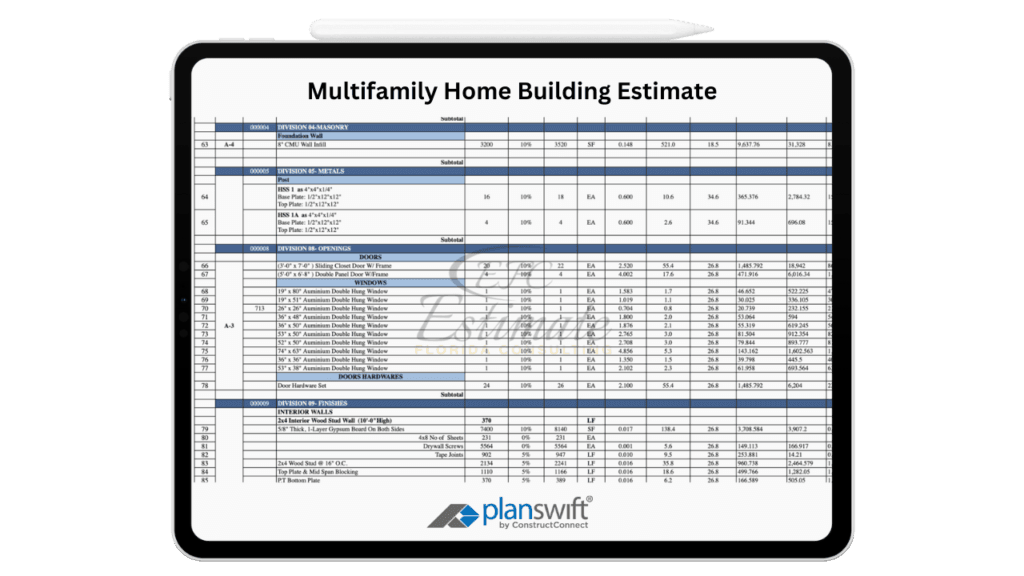

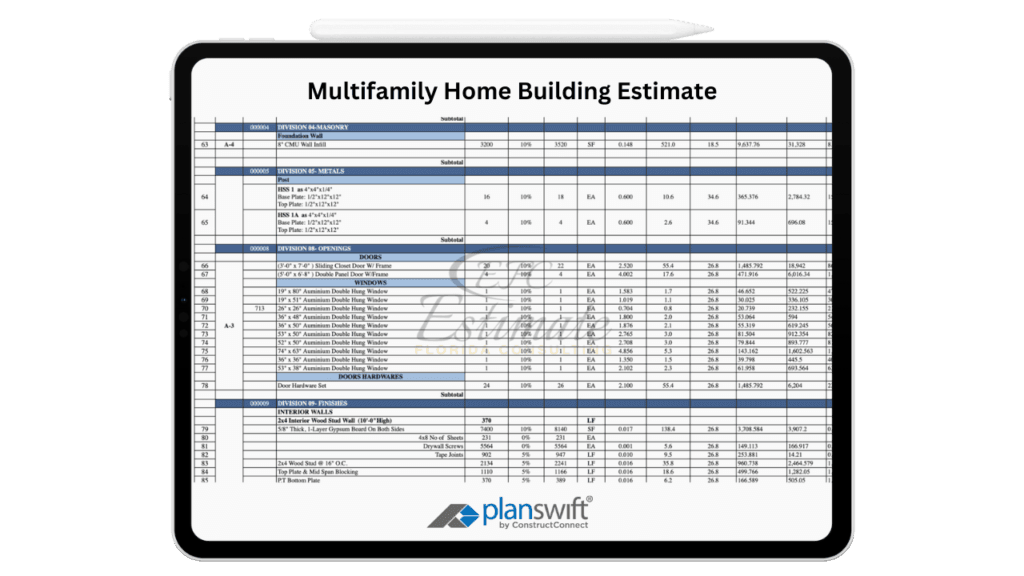

Leveraging technology by using construction estimating software can streamline the estimation process and significantly enhance accuracy. Many software solutions offer templates and cost databases that allow you to input project specifics and receive detailed estimates automatically. These tools can help eliminate manual calculations, reducing the likelihood of errors and discrepancies. Additionally, many estimating software programs provide features like cost tracking, budget management, and project forecasting, allowing you to adjust your estimates as the project progresses. Familiarize yourself with different software options available on the market, and choose one that aligns with your project needs and complexity. Investing in reliable software can save time and improve your overall project management capabilities.

No construction project is without unexpected challenges. Therefore, it’s crucial to include a contingency budget of around 10% to 15% of the total project cost to accommodate unforeseen expenses. This buffer can cover unexpected increases in material costs, delays in the construction timeline, or additional labor expenses. When preparing your budget, outline potential risks and uncertainties that could impact costs, such as fluctuations in market prices or supply chain disruptions. By proactively planning for these contingencies, you can mitigate financial stress and avoid compromising project quality or timelines due to budget constraints. Additionally, regularly revisiting your contingency plans throughout the project can help ensure that your budget remains adaptable to any changes.

Successfully developing a multifamily home project requires a strategic approach that encompasses thorough planning, market understanding, and community involvement. Here are some essential tips to enhance your project’s chances of success:

Investing time in thorough planning is crucial to avoid costly mistakes during construction. Begin by outlining clear project timelines, objectives, and milestones to guide the development process. Consider creating a comprehensive project plan that includes detailed schedules for each phase of construction, from pre-development activities to final inspections. Additionally, establish a realistic budget that accounts for all potential costs, including construction, permits, labor, and contingencies. Engaging a project manager can help oversee these plans, ensuring that all stakeholders are aligned and that the project remains on track. Thorough planning not only streamlines the development process but also minimizes the risk of delays and unexpected expenses.

Conducting a detailed analysis of the local real estate market is essential for understanding demand, pricing trends, and tenant preferences. Analyze demographic data to identify target markets, such as families, young professionals, or retirees, and tailor your project accordingly. Assess the local competition by reviewing similar multifamily developments in the area, noting their pricing structures, amenities, and occupancy rates. This information can help you position your project effectively in the market and ensure that it meets the needs of potential tenants. Additionally, consider engaging local real estate experts or market analysts who can provide insights into future market trends and economic factors that may impact your project.

Incorporating sustainable building practices and materials can enhance the property’s appeal and potentially lower operating costs. Emphasize energy-efficient designs, such as high-quality insulation, energy-efficient windows, and renewable energy sources like solar panels. These features not only reduce utility costs for tenants but can also qualify the building for tax incentives or green certifications, enhancing its marketability. Additionally, using sustainable materials and practices during construction can attract environmentally conscious tenants and improve the long-term value of the property. Consider partnering with sustainability consultants who can advise you on best practices and certifications that align with your development goals.

Engaging the community in the planning process is essential to gather input and support, ultimately leading to a project that meets local needs. Host community meetings or focus groups to solicit feedback on your development plans, addressing any concerns residents may have. This involvement not only fosters goodwill among potential tenants but also helps you tailor your project to fit seamlessly within the neighborhood. Additionally, building relationships with local stakeholders, including city officials and neighborhood associations, can help ease the approval process and ensure compliance with local regulations. Community engagement can also lead to valuable partnerships, enhancing your project’s overall success.

Building a multifamily home requires careful planning, financial foresight, and an understanding of the various factors that influence costs. From land acquisition and design choices to permits and labor expenses, each aspect plays a crucial role in determining the overall budget. By conducting thorough research, collaborating with industry experts, and implementing effective estimation strategies, developers can set themselves up for success in their multifamily construction endeavors.

The average cost to build a multifamily home varies widely based on location, design, and type. Generally, the cost ranges from $156 to $520 per square foot. Low-rise apartments typically cost between $156 and $325 per square foot, while high-rise apartments can cost between $325 and $520 per square foot.

Several factors can influence costs, including:

Financing options for multifamily construction include:

Land costs can vary dramatically based on the location. In urban areas, land can cost up to $1,950,000 per acre, while suburban and rural areas typically range from $130,000 to $650,000 and $26,000 to $130,000 per acre, respectively. It’s essential to incorporate land acquisition costs into your overall budget to ensure accurate financial planning.

Permits and fees can vary significantly based on local regulations. Common permits include:

To estimate costs effectively:

At Estimate Florida Consulting, we offer detailed cost estimates across all major trades, ensuring no part of your project is overlooked. From the foundation to the finishing touches, our trade-specific estimates provide you with a complete and accurate breakdown of costs for any type of construction project.

We take pride in delivering accurate, timely, and reliable estimates that help contractors and builders win more projects. Our clients consistently praise our attention to detail, fast turnaround times, and the positive impact our estimates have on their businesses.

Estimate Florida Consulting has helped us win more bids with their fast and accurate estimates. We trust them for every project!

Submit your project plans, blueprints, or relevant documents through our online form or via email.

We’ll review your project details and send you a quote based on your scope and requirements.

Confirm the details and finalize any adjustments to ensure the estimate meets your project needs.

Receive your detailed, trade-specific estimate within 1-2 business days, ready for your project execution.

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

All copyright © Reserved | Designed By V Marketing Media | Disclaimer