- Homepage

- Blogs

Canada Real Estate 2026: Worth it for U.S. Investors?

Canada has been a magnet for investors due to its resilient economy, growing cities, and a favourable exchange rate. Particularly for U.S. investors looking to diversify and expand their market across borders.

But with changing policies and economic fluctuations, is it still worth the investment? If strategized wisely, Canada could offer fantastic opportunities for investors, however the success depends on if they know how to navigate the market.

Discovering Canada: A Lucrative Real Estate Market

Canada’s real estate market is dynamic with ever-increasing demands, shifting trends, and regional contrasts brimming with opportunities for investors. Key hotspots like Toronto, Vancouver, Calgary, Niagara, and Montreal as well as increasing migration in the coast of the Atlantic continue to provide high potential for investors. So, it is not a surprise that U.S. investors are eyeing the country as a prime destination to invest in.

But is it really as smooth as it seems? Not really, evolving regulations, restrictions for foreign buyers, taxation policies, and fluctuating economy requires investors to do careful planning.

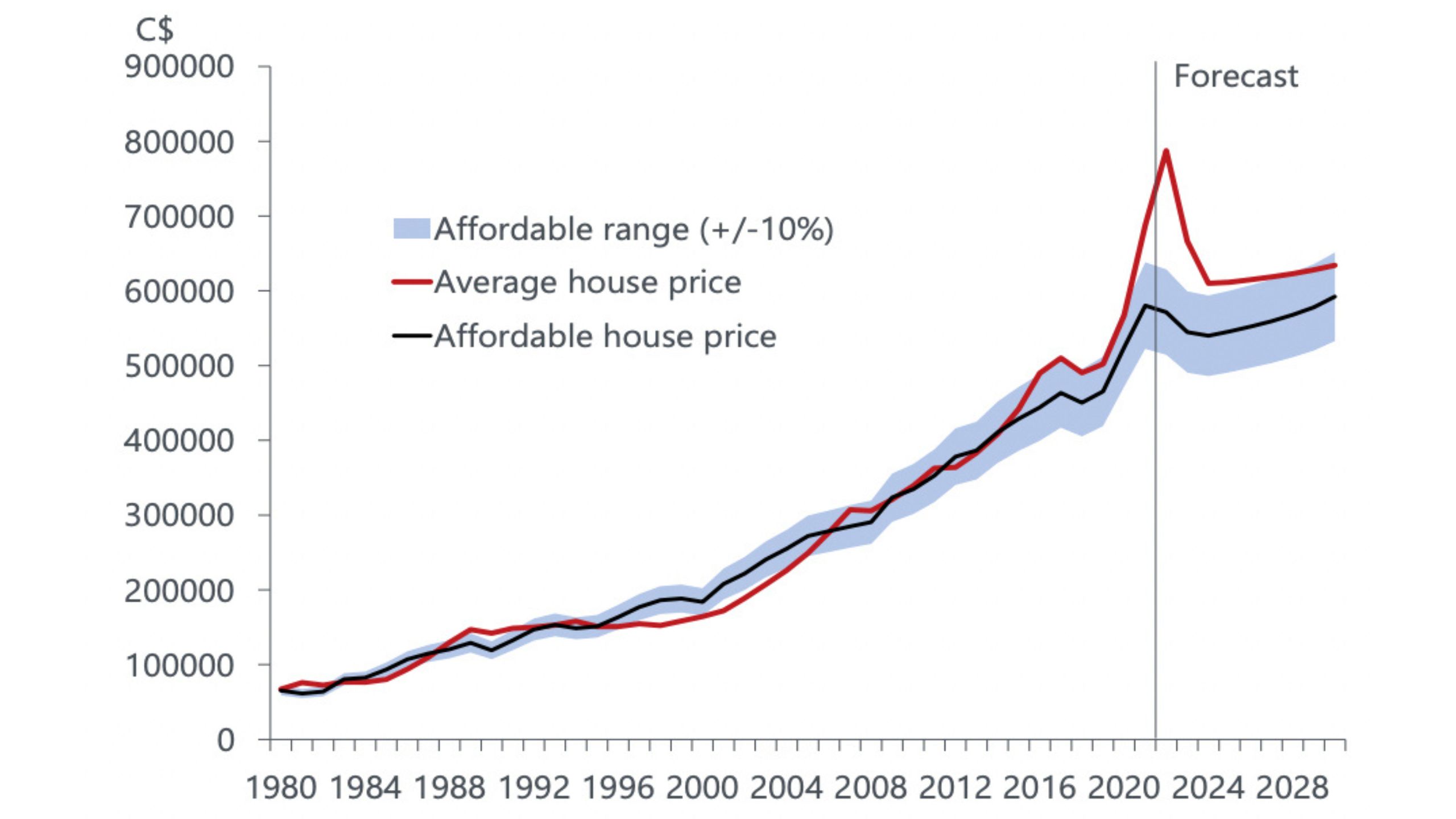

For example, if we take a look into the trends of the past few years, especially during the pandemic, Canada has experienced a rise in home prices to a staggering 55% reaching its peak in 2022. However the market experienced a 14% decline since then. reuters.com

Therefore, investors should stay informed about the current market trends, and economy to strategize correctly.

As Jamie Szeibert, Realtor and Team Lead at Szeibert Realty Group states,

“In today’s fluctuating market, it’s imperative for investors to thoroughly research and adapt to the evolving economic and regulatory landscape to make informed decisions.”

Emerging Trends and forecast

As we move into the year 2026, Canada’s real estate market is undergoing significant transformations. Let’s take a look at the current trends and forecast—

1. Increased Immigration

Canada is known for its record number of immigration levels. In 2024, approximately 483,390 new permanent residents entered Canada , a slight increase from the previous year 2023, which was 471,771 new permanent residents. Immigration-Statistics-2024

As a result, the current housing crisis has driven the demand for housing properties in many regions.

2. Market Growth

The real estate market of Canada is now recovering and growing at a modest rate after the pandemic. At the beginning of the year 2026, the national average home price was approximately $670,064, a decline by 1% from December 2024. WOWA.CA

The Canadian Real Estate Association (CREA) shows a forecast a 4.7% annual increase in the national average home price, reaching $722,221 in 2026, which is only a slight change from the 4.4% increase forecast from October 2024. crea.ca

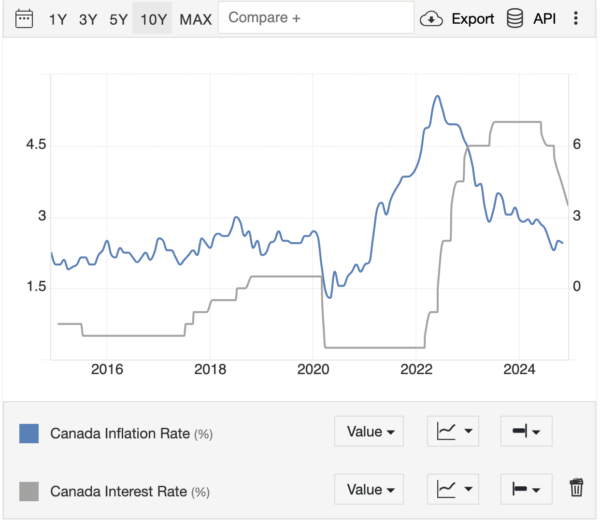

3. Interest Rate Changes

By the middle of 2026, The Bank of Canada (BoC) is expected to lower the interest rates .The rate is expected to decrease to between 2.00% to 3.00%. Which could simulate housing demands by making mortgages and interest rates more affordable.

4. Affordability Challenges

Issues like affordability are predicted to remain in 2026 due to increasing property prices and living costs. In December 2024, the national average price for an individual house was $855,900, while the average price for apartments was $507,400. globalnews.ca

Regarding the concern, Canadian real estate expert Sarah Mitchell says

“Rising prices and higher living costs are pushing more people into the rental market. Investors who focus on rental properties in high-demand areas will likely see strong returns in the coming years.”

5. Provincial Market Outlook

Canada’s vast geography and growing population are opening doors and unlocking new opportunities for potential investors. Ontario is a growing financial hub with major cities like Toronto, Ottawa, and Niagara offering property appreciation and high rental demand.

Alberta with no provincial tax and a business friendly environment offers high property demand in Calgary and Edmonton.

In British Columbia, cities like Kelowna and Victoria are now becoming more popular. In the Atlantic Coast, Halifax and St. John’s are now experiencing a population boom due to increased immigrants.

The provincial market of Canada is hugely beneficial for investors seeking long term opportunities.

Benefits of Investing in Canada’s Real Estate: Why U.S. Should Consider Investing in Canada

Investing in Canada’s real estate offers U.S. investors stability, strong ROI, and growth potential for the long term. The key benefits include—

1. Favourable Currency Exchange

The U.S. dollar holds a higher value than the Canadian dollar allowing U.S investors to invest in Canadian properties at a relatively low and discounted prices.

2. Stable Economy

Canada’s strong banking system and economy provide investors a stable investment environment which can minimize potential risks and ensure security.

3. Thriving Rental Market

Due to increasing immigrant numbers every year, demand for student and family rental are at an increasing rate, which could potentially give U.S. investors more opportunities to invest and expand their businesses in Canada.

4. Urban and Infrastructure Development

With a growing population in almost every province, Canada is booming with rapid urbanization and infrastructure development to accommodate its inhabitants. U.S. inventors can capitalize on high-demand properties.

Potential Risks and Challenges

Although Canada offers tons of new opportunities, it also comes with its fair share of challenges.

U.S. investors must be aware of challenges like foreign buyer restrictions in high demanded cities. They also may face additional tax charges which can affect their profitability. Additionally, U.S. buyers also may face property management challenges. Managing a property remotely can be a big challenge in terms of logistics.

Strategies to Adapt: Joint-Venture Local Partner Model

A joint-venture local partner model can help U.S. investors to navigate through such challenges easily. A Canadian partner can provide American investors with local market knowledge and access to local networks and connections which can ensure a smooth operation across borders. Real Estate coach Russell Westcott states,

“Most sophisticated and successful multi-millionaire real estate investors utilize Joint Ventures to create wealth at an accelerated pace.”

Is it worth it?

To answer all the questions, though it might be challenging to overcome the potential risks, Canada’s real estate is dynamic and a strong investment opportunity for U.S. investors who may be able to navigate it wisely. The challenge may not diminish itself, so it is essential to plot strategic investment plans for those willing to expand the real estate business in Canada.