90% More Chances to Win Projects With Our Estimate!

- Multi-Family Building

- Hotel Building

- Hospital Building

- Warehouse Building

- School & University Building

- High-Rise Building

- Shopping Complex

- Data Center Building

When applying for a bank loan to fund a construction project, presenting a detailed and accurate construction estimate is essential. This estimate gives the bank a clear picture of the project’s total cost, potential risks, and feasibility. Whether it’s for a residential home, commercial building, or renovation, a construction estimate for a bank loan must cover all aspects, from labor and materials to permits and contingency budgets. Without a comprehensive cost breakdown, securing a loan can become difficult, as banks need to see the project’s financial stability and predictability. This guide offers a detailed look at how to prepare a construction estimate tailored for bank loans, including essential components, common factors, and useful tips.

Banks require a detailed construction estimate to assess the financial risks involved in the project and to decide whether the borrower is creditworthy. The estimate provides the lender with a breakdown of how the loan will be spent, ensuring that all phases of construction are covered, from land acquisition to the final finishing touches. A well-prepared estimate helps banks avoid potential losses and guarantees that the project can be completed within budget. By showing that every element of the construction has been accounted for, you increase the likelihood of loan approval, as it demonstrates financial planning and responsibility.

A solid construction estimate comprises several critical elements that banks carefully examine before approving a loan. These components include land acquisition, site preparation, materials and labor, permits and legal fees, and a contingency budget for unexpected costs. Each of these categories must be thoroughly researched and documented to present an accurate picture of the total project cost. Let’s dive deeper into each component to understand why they’re essential and how they impact the overall estimate.

For new construction projects, land acquisition is the first major cost that needs to be addressed in the estimate. The price of land can vary dramatically depending on the location, proximity to urban centers, and available infrastructure. When banks review construction loan applications, they look at the land’s value relative to the project, ensuring that it matches the scope of the construction. Factors such as zoning laws, future development plans, and environmental regulations may also impact the land’s value and the loan approval process. Therefore, it’s crucial to present the bank with a well-researched and up-to-date valuation of the land.

Location | Land Acquisition Cost |

Urban Areas | $130,000 – $520,000 |

Suburban Areas | $85,000 – $300,000 |

Rural Areas | $65,000 – $120,000 |

Site preparation is a fundamental part of the construction estimate and includes tasks such as clearing the land, leveling the terrain, and installing essential infrastructure like drainage systems. Banks expect this cost to be part of the initial budget because these tasks must be completed before the actual building can begin. Additionally, the site preparation cost can increase if the land requires extensive grading, tree removal, or soil stabilization. By accounting for these variables in the estimate, you present the bank with a realistic expectation of how much work needs to be done before construction can commence.

Project Size (sq ft) | Site Preparation Cost |

2,500 sq ft | $13,000 – $28,600 |

5,000 sq ft | $19,500 – $39,000 |

Material and labor costs form the backbone of the construction estimate and account for the largest portion of the total budget. Materials such as concrete, lumber, steel, and glass can fluctuate in price depending on market demand and availability, making it crucial to use current pricing in your estimate. Labor costs also vary based on local wage rates, the complexity of the project, and the availability of skilled workers. A thorough and realistic calculation of both material and labor costs will help ensure that the loan amount covers these essential expenses. It’s also important to factor in lead times for material procurement, as delays can affect labor scheduling and overall project timelines.

Material Type | Estimated Cost per Unit |

Concrete (per cubic yard) | $130 – $200 |

Steel (per ton) | $1,800 – $2,500 |

Lumber (per board foot) | $4.00 – $5.50 |

Every construction project must comply with local building codes and regulations, which involve obtaining various permits and paying fees. Legal costs also come into play when drafting contracts, obtaining approvals, and handling zoning issues. Including these expenses in your construction estimate ensures that you are prepared for all the regulatory hurdles the project may face. Banks will expect to see these costs in the estimate because projects without proper permits or legal backing can face delays or even be halted, increasing the risk to the lender.

Type of Permit/Cost | Estimated Cost |

Building Permits | $2,000 – $5,000 |

Zoning Approvals | $1,500 – $3,000 |

Legal Fees | $2,000 – $5,000 |

Residential construction projects, including single-family homes and multi-family buildings, require precise cost estimates to avoid budget overruns. The cost of constructing a residential building is influenced by factors such as the size of the home, architectural complexity, choice of materials, and local labor rates. When presenting an estimate to a bank for a residential project, it’s crucial to include all aspects of the construction process, from foundation work to final finishes like flooring and cabinetry. Banks are particularly interested in ensuring that the loan covers the full scope of the project, reducing the risk of incomplete construction due to budget constraints.

Home Size (sq ft) | Estimated Cost |

1,500 sq ft | $195,000 – $390,000 |

2,500 sq ft | $325,000 – $650,000 |

3,500 sq ft | $455,000 – $910,000 |

Beyond basic construction costs, residential projects often involve additional expenses such as landscaping, driveway installation, and utility hookups. These extra costs must be included in the estimate to ensure the project is fully funded. Banks prefer to see a comprehensive breakdown that accounts for all possible expenses, helping to prevent financial shortfalls during construction.

Commercial construction projects, such as office buildings, retail centers, and industrial facilities, generally involve higher costs due to their larger scale and the need for specialized materials and labor. The design and functionality of commercial buildings often require more complex structural and mechanical systems, which increase the overall cost of construction. When submitting a commercial construction estimate for a bank loan, it’s essential to provide detailed information about the type of building, its intended use, and any special requirements such as energy-efficient systems or advanced security features.

Commercial Building Size (sq ft) | Estimated Cost |

10,000 sq ft | $1,300,000 – $6,500,000 |

50,000 sq ft | $6,500,000 – $32,500,000 |

In addition to the standard construction costs, commercial projects often require additional services such as site-specific engineering, advanced HVAC systems, and compliance with accessibility regulations. These specialized costs must be accounted for in the estimate to ensure the project meets all regulatory requirements and functions as intended. Banks look favorably upon estimates that include these details, as they demonstrate a thorough understanding of the project’s complexity.

Calculating the total construction cost for a project involves aggregating the expenses associated with land acquisition, site preparation, materials, labor, permits, and contingency funds. A well-structured estimate should break down each cost category into specific line items to provide a clear picture of the overall budget. When preparing an estimate for a bank loan, it’s important to ensure that every phase of the project is accounted for, from initial site work to the final walkthrough. This level of detail reassures the bank that the loan will cover all expenses and that the project has a high likelihood of being completed on time and within budget.

Several factors can affect the accuracy of a construction estimate, and banks take these into account when reviewing loan applications. Material costs, for example, can fluctuate based on supply chain issues, global demand, and regional availability. Similarly, labor costs can vary depending on the local job market, the complexity of the work, and the availability of skilled workers. Other factors such as weather conditions, site accessibility, and regulatory requirements can also impact the final cost of a construction project. It’s important to consider these variables when preparing your estimate to ensure it is as accurate as possible.

Market conditions such as rising inflation, global shortages of construction materials, and increased transportation costs can all impact the total construction estimate. Preparing for these external factors by researching current trends and adjusting costs accordingly is crucial for creating a bank-ready construction estimate.

A critical element that every bank looks for in a construction estimate is the inclusion of a contingency budget. This is a reserved amount of money set aside to cover unexpected expenses that may arise during the construction process. From unexpected delays due to weather conditions to rising material costs or unforeseen structural issues, a contingency fund helps ensure that the project stays on track financially.

Banks typically expect to see contingency amounts range from 5% to 15% of the total project cost. Including a contingency budget in your estimate gives the bank confidence that you are prepared for any surprises, minimizing the risk of running over budget and defaulting on the loan.

Total Project Cost | Contingency Budget |

$500,000 | $32,500 – $97,500 |

$1,000,000 | $65,000 – $195,000 |

$5,000,000 | $325,000 – $975,000 |

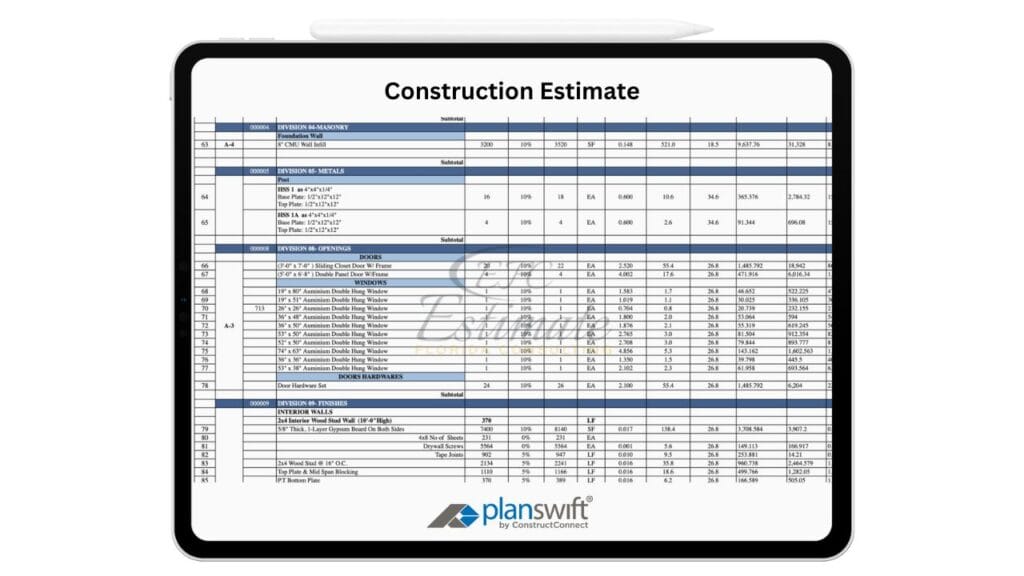

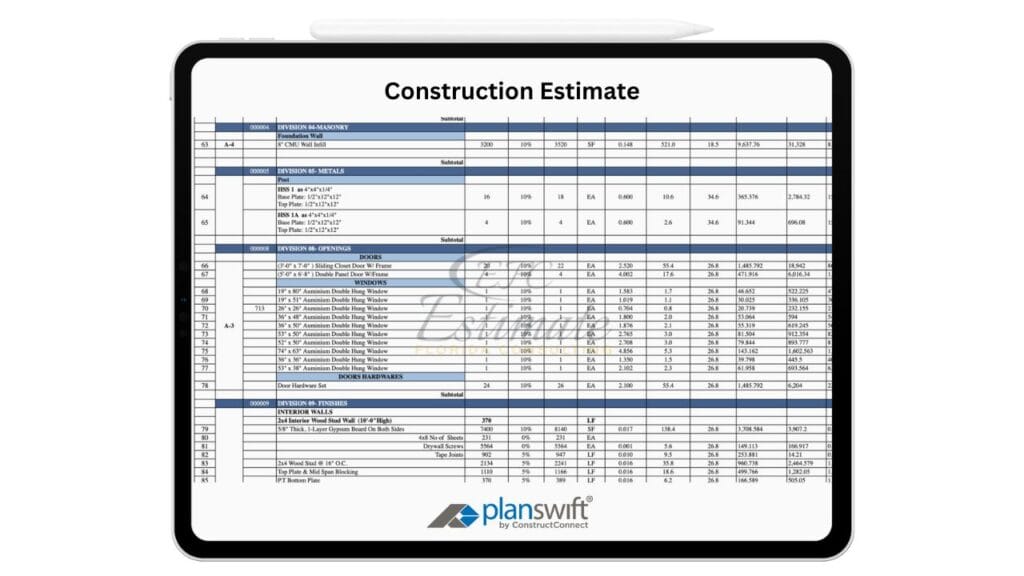

When presenting a construction estimate to a bank for loan approval, the structure of the document plays a significant role in how quickly and smoothly the process goes. A well-organized estimate that breaks down every aspect of the project allows the bank to assess the financial risk more accurately. Typically, banks prefer estimates that are structured into clearly defined sections, which should include the following:

By clearly structuring the estimate, you help streamline the bank’s review process, increasing the chances of loan approval. Providing banks with precise information builds trust and signals that the project is well-managed.

To ensure accuracy and improve the chances of loan approval, it is often beneficial to seek professional estimation services. Professional estimators have a deep understanding of market trends, labor rates, and material costs, which allows them to provide highly accurate construction cost estimates. In Florida, professional estimators such as those at Florida Consulting Services offer expert insights tailored to the local construction market.

Using a professional estimator also enhances your credibility with banks. They know the estimate has been prepared by an expert, which reduces the perceived risk of underestimating costs or facing unexpected financial challenges. By working with an experienced estimator, you can produce a construction estimate that reflects realistic costs, increasing your chances of securing the loan and successfully completing the project.

Once your construction estimate is complete, it’s important to review it carefully for accuracy before submitting it to the bank. Double-checking each line item and cost ensures that nothing has been missed, and that you have accounted for every phase of the project. In some cases, banks may request revisions to the estimate, especially if they believe certain costs have been underestimated or certain aspects of the project have been overlooked.

Being open to revisions and providing updated estimates when requested can demonstrate your commitment to the project and improve the bank’s confidence in your ability to manage it. A flexible approach during the estimate review process increases the likelihood of loan approval.

When preparing a construction estimate for a bank loan, it’s essential to understand the difference between a construction loan and a mortgage. A construction loan is typically short-term and is used to fund the building process, while a mortgage is a long-term loan that covers the finished property. Construction loans are often more complex to obtain, as they involve higher risks for lenders. Therefore, banks require more detailed and accurate construction estimates for these loans compared to traditional mortgages.

Once the construction is complete, many borrowers choose to convert their construction loan into a mortgage. This transition requires the completion of the project within the budget, as any delays or cost overruns could impact the ability to convert the loan successfully.

To ensure that your construction estimate is ready for submission, take the following final steps:

By following these steps, you present the bank with a construction estimate that is both detailed and credible, increasing your chances of securing the loan and moving forward with the project.

Securing a construction loan is a critical step in any building project, whether it’s residential, commercial, or industrial. A well-prepared construction estimate is key to obtaining the necessary funding from a bank. By breaking down costs, planning for contingencies, and presenting a thorough financial plan, you demonstrate to the bank that the project is feasible and that you have accounted for all potential risks.

A contingency budget is a reserve of funds set aside to cover unexpected costs that may arise during construction, such as delays, material price increases, or unforeseen structural issues. It helps ensure that the project stays on budget, even when unexpected expenses occur.

Banks typically expect a contingency budget to range from 5% to 15% of the total project cost. This range can vary depending on the complexity and size of the project. For example, on a $1,000,000 project, a contingency fund could range from $65,000 to $195,000.

Banks see a contingency budget as a risk management tool. It reassures them that the borrower is prepared for any unexpected challenges and that the project is less likely to run over budget or default on the loan.

A solid construction estimate should include:

Professional estimators bring expertise in market trends, labor rates, and material costs, ensuring a highly accurate estimate. Banks view estimates prepared by professionals as more reliable, which can increase the likelihood of loan approval.

Banks may request revisions if they feel certain costs are underestimated or missing. Being open to revising the estimate based on their feedback demonstrates flexibility and commitment, which improves your chances of securing the loan.

A construction loan is a short-term loan used to finance the building process, while a mortgage is a long-term loan used to finance the finished property. Construction loans often have stricter requirements, making detailed estimates essential for approval.

A contingency budget ensures that unexpected costs don’t derail your project or cause you to run out of funds. It provides a financial buffer that helps keep the project on track even when challenges arise.

At Estimate Florida Consulting, we offer detailed cost estimates across all major trades, ensuring no part of your project is overlooked. From the foundation to the finishing touches, our trade-specific estimates provide you with a complete and accurate breakdown of costs for any type of construction project.

We take pride in delivering accurate, timely, and reliable estimates that help contractors and builders win more projects. Our clients consistently praise our attention to detail, fast turnaround times, and the positive impact our estimates have on their businesses.

Estimate Florida Consulting has helped us win more bids with their fast and accurate estimates. We trust them for every project!

Submit your project plans, blueprints, or relevant documents through our online form or via email.

We’ll review your project details and send you a quote based on your scope and requirements.

Confirm the details and finalize any adjustments to ensure the estimate meets your project needs.

Receive your detailed, trade-specific estimate within 1-2 business days, ready for your project execution.

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

All copyright © Reserved | Designed By V Marketing Media | Disclaimer