90% More Chances to Win Projects With Our Estimate!

- Multi-Family Building

- Hotel Building

- Hospital Building

- Warehouse Building

- School & University Building

- High-Rise Building

- Shopping Complex

- Data Center Building

The cost of installing commercial solar panels has seen significant reductions over the past decade, dropping by more than 50%. This decline has made solar energy a more viable option for many businesses looking to offset their energy expenses. Below is a summary of the updated costs associated with installing commercial solar panels based on different business sizes and types:

Business Size / Type | System Size (kW) | *Total Installed Cost (Before Tax Credits) |

Small | 15 – 25 | $45,000 – $105,000 |

(Retail boutiques, small clinics, small offices) | ||

Small-Medium | 26 – 50 | $78,000 – $210,000 |

(Large retail stores, medium-sized office buildings) | ||

Medium | 51 – 100 | $153,000 – $420,000 |

(Commercial farms, warehouses) | ||

Large | 101 – 250 | $303,000 – $1,050,000 |

(Schools, hospitals, factories) | ||

Extra-Large | 300 – 350 | $900,000 – $1,470,000 |

(Large shopping malls, industrial factories) |

The commercial solar sector encompasses a wide range of non-residential properties, making solar energy a versatile solution for many industries. Typical sectors include:

Commercial solar panel systems cost an average of $1.66 per watt as of 2023. This is almost half the cost per watt for residential projects, which stands at $3.27.

Based on these average cost figures, we can estimate the costs of commercial solar power systems of various sizes:

System Size | Suitable For | Cost |

15 kW | Retail outlet, clinic, etc. | $29,880 |

75 kW | Farm, warehouse, etc. | $149,400 |

350 kW | Factory, hospital, school, etc. | $697,200 |

The following table details a typical cost breakdown for a commercial solar system installation. These percentages reflect the average costs associated with each component, and specific costs may vary based on various factors.

Factor | Percentage of Total Cost |

Solar Panels | 40% |

Balance of System | 36% |

(All other components making up the solar array—mounting structures, inverter, cables, wiring, electrical panel, etc.) | |

Installation | 24% |

Total System Cost | 100% |

Commercial solar panels can be installed in several ways, depending on the property. Generally, fixed panel installations are more cost-effective than advanced tracking systems. Here are some common installation options:

Numerous incentives are available to help offset the substantial cost of a commercial solar system. While federal tax credits are universally available, other incentives can vary significantly by state, utility, and local governments. The table below outlines some of these incentives.

Incentive Type | Description |

Federal Investment Tax Credit (ITC) | The ITC reduces federal income tax liability for a percentage of a solar system installed during the tax year. Systems installed after 2022 and projects starting before 2033 are eligible for a 30% ITC. |

Production Tax Credit (PTC) | A per kilowatt-hour (kWh) tax credit for renewable electricity generated for the first 10 years of operation. This credit reduces federal income tax liability and adjusts for inflation each year, offering 2.75 ¢/kWh PTC for eligible systems. |

Property & Sales Tax Exemptions | If the solar panel installation increases the business’s property value, the added value (or a percentage) is exempt from property tax. Many states also do not require sales tax on solar panels and system components. |

Solar Renewable Energy Credits (SRECs) | In some states, businesses can sell excess energy to the SREC market, which is used by public utilities to meet renewable energy generation requirements. |

USDA Rural Energy of America Program (REAP) Grant | Agricultural producers and rural small businesses can secure guaranteed loan financing and grant funding for solar energy systems or efficiency improvements, with a maximum grant size of $1.2 million for renewable energy systems and $600,000 for energy efficiency projects. |

Modified Accelerated Cost Recovery System (MACRS) | This accelerated depreciation method allows businesses to deduct up to 102% of the entire system cost over a 5-year period, which can be used in conjunction with the federal solar investment tax credit. |

Net Metering | Businesses receive credits on their electric bill for the excess energy sent back to the public grid, though net metering is not available in all states. |

While paying cash upfront for the entire installation yields the most financial benefit, businesses without sufficient capital have several financing options to go solar with little to no money upfront.

Financing Method | Eligible for Solar Incentives? | Description |

Power Purchase Agreement (PPA) | No | The business pays a guaranteed fixed rate for the electricity used during the contract term (typically 10 to 20 years). The business does not qualify for tax credits or incentives as the utility or solar company owns and maintains the panels. |

Solar Loan | Yes | The business borrows funds from a bank or solar company, making payments over time. Although the total cost is higher than a cash payment due to interest, energy savings often exceed the monthly payment. |

Solar Lease | No | This option allows business owners who rent their space to go solar. The business pays a monthly fee—typically lower than public electricity rates—to power their operations with the solar energy generated. Similar to a PPA, the solar company owns, installs, and maintains the equipment. |

Commercial Property Assessed Clean Energy (C-PACE) Model | Yes | The debt for financing the solar system is tied to the property rather than the business entity and is transferable to future buyers willing to accept it. C-PACE is ideal for businesses uncertain about remaining in their current location long-term. |

Commercial solar panel systems are generally larger than residential systems due to the larger property sizes and greater electricity demands typical of commercial buildings. Consequently, while commercial systems often have a higher total cost, they may be more cost-effective on a per-watt basis because of economies of scale.

Before tax credits or incentives, residential solar panels cost $3.60 to $5.40 per watt installed on average.

Both commercial and residential solar energy systems are eligible for the federal tax credit, which helps reduce the overall cost for both types of installations.

Commercial solar panel installations often require longer completion times, primarily due to the extensive research, planning, design, and permitting processes involved. These factors can add complexity and duration to commercial projects compared to residential installations.

Commercial solar panel systems are generally larger than residential systems due to the larger property sizes and greater electricity demands typical of commercial buildings. Consequently, while commercial systems often have a higher total cost, they may be more cost-effective on a per-watt basis because of economies of scale.

Before tax credits or incentives, residential solar panels cost $3.60 to $5.40 per watt installed on average.

Both commercial and residential solar energy systems are eligible for the federal tax credit, which helps reduce the overall cost for both types of installations.

Commercial solar panel installations often require longer completion times, primarily due to the extensive research, planning, design, and permitting processes involved. These factors can add complexity and duration to commercial projects compared to residential installations.

The table below showcases Solar Power World’s top 10 commercial solar contractors of 2024. These companies installed the most kilowatts (kW) for commercial solar energy systems in 2024.

Company | Headquarters | Primary Service | Total kW Installed in 2024 |

Radiance Solar | GA | EPC | 215,908 |

ACE Solar | MA | EPC | 176,362 |

Next Generation Solar | NY | Installer | 119,417 |

MBL-Energy | CA | Installation Subcontractor | 105,060 |

DCE Services | NC | Installation Subcontractor | 81,683 |

Ameresco | MA | Developer | 78,214 |

PowerFlex | NY | Developer | 76,719 |

Knobelsdorff | NM | EPC | 73,370 |

Coldwell Solar | CA | EPC | 72,875 |

Standard Solar | MD | Developer | 59,688 |

Installing a commercial solar panel system offers numerous advantages and few drawbacks. While solar energy is dependent on sunlight and the installation often requires roofing and system upgrades—adding to an already high upfront cost—the positives tend to outweigh the negatives in many scenarios.

The cost of installing commercial solar panels has significantly decreased over the past decade, dropping by more than 50%. Currently, the price ranges depending on the size and type of the business:

Several factors can affect the cost, including:

Yes! Various federal and local incentives are available, including:

Businesses can save up to 75% on their electricity bills after transitioning to solar. This significant reduction helps offset the installation costs over time.

There are several financing options available:

Commercial solar systems are generally larger and more cost-effective on a per-watt basis due to economies of scale. While residential systems cost between $3.60 and $5.40 per watt, commercial systems average around $1.66 per watt.

The typical breakeven period for a commercial solar system ranges from 3 to 7 years, leading to significant long-term savings.

Installation methods include:

Evaluate energy consumption, the suitability of the installation site, and available incentives. It’s also crucial to consider the long-term financial benefits against the initial installation costs.

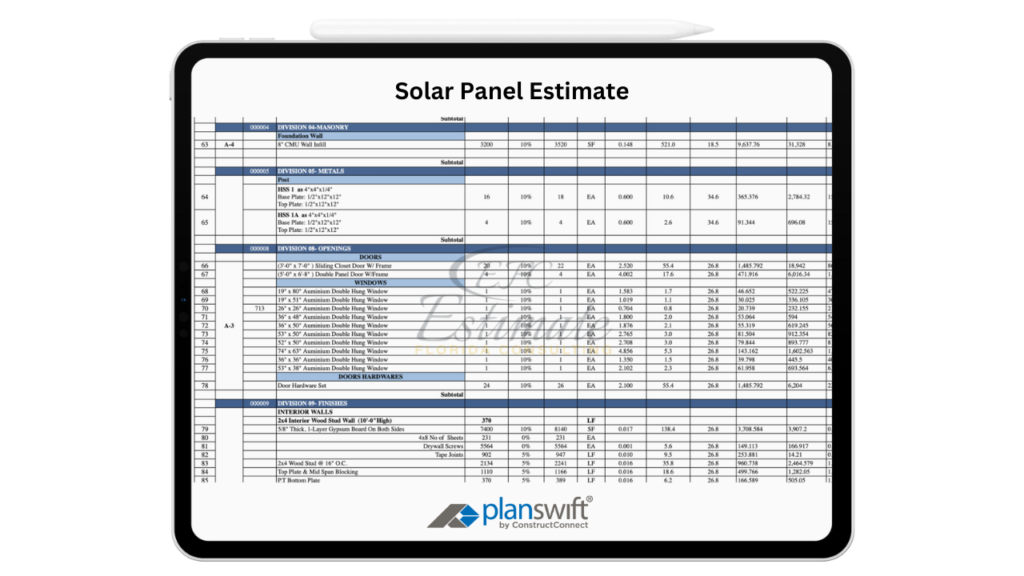

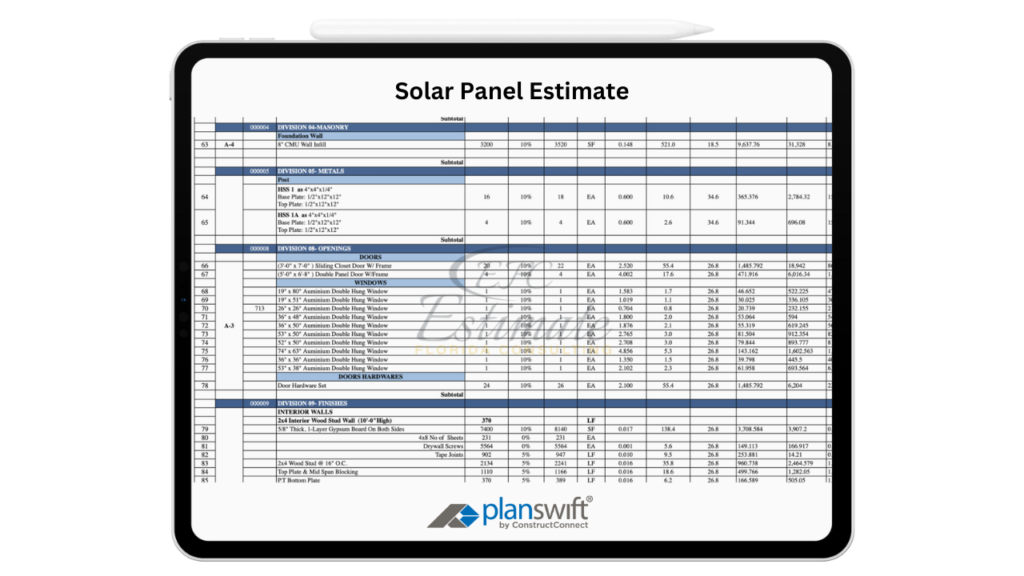

At Estimate Florida Consulting, we offer detailed cost estimates across all major trades, ensuring no part of your project is overlooked. From the foundation to the finishing touches, our trade-specific estimates provide you with a complete and accurate breakdown of costs for any type of construction project.

We take pride in delivering accurate, timely, and reliable estimates that help contractors and builders win more projects. Our clients consistently praise our attention to detail, fast turnaround times, and the positive impact our estimates have on their businesses.

Estimate Florida Consulting has helped us win more bids with their fast and accurate estimates. We trust them for every project!

Submit your project plans, blueprints, or relevant documents through our online form or via email.

We’ll review your project details and send you a quote based on your scope and requirements.

Confirm the details and finalize any adjustments to ensure the estimate meets your project needs.

Receive your detailed, trade-specific estimate within 1-2 business days, ready for your project execution.

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

561-530-2845

info@estimatorflorida.com

Address

5245 Wiles Rd Apt 3-102 St. Pete Beach, FL 33073 United States

All copyright © Reserved | Designed By V Marketing Media | Disclaimer